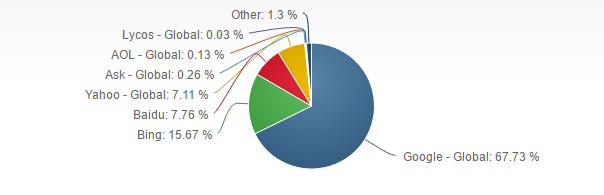

На сегодняшний день Google – самая популярная поисковая система в мире с общим охватом пользователей – 67,7% по данным marketshare.hitslink.com на февраль 2016 года.

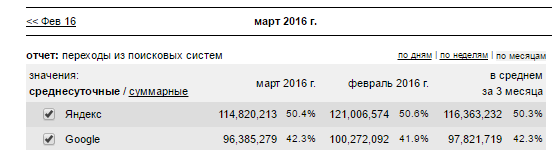

По данным статистики liveinternet.ru, в России по количеству трафика Яндекс опережает Google, но лишь на 9% (на февраль 2016 года), что отражает необходимость продвижения в обеих поисковых системах.

Многие рекламодатели уже размещают рекламу в Яндекс.Директ, но пренебрегают рекламой Гугл Адвордс, хотя конкуренция там значительно ниже. Это связано с двумя причинами:

-

рекламодатели считают, что настроить рекламную кампанию в Google.AdWords сложно;

-

размещаться в сервисе AdWords не имеет смысла при размещении рекламы в Директе.

Но мы развеем данные мифы и поможем разобраться в некоторых особенностях размещения рекламы в Google Ads. (До 2018 рекламный инструмент назывался Google AdWords)

Что такое Google AdWords?

Google Ads — это сервис контекстной рекламы компании Google, ранее известный как Гугл Адвордс, предоставляющий структурированный интерфейс и большое количество инструментов для создания эффективных рекламных объявлений. Несмотря на то, что охват аудитории у Google в России меньше, чем у Яндекса, конкуренция и ставки при размещении рекламы в Adwords также меньше. Отмечу, что аудитория этих систем пересекается на небольшое общее количество процентов трафика.

Принципы создания рекламных кампаний в Google Adwords.

Интерфейс

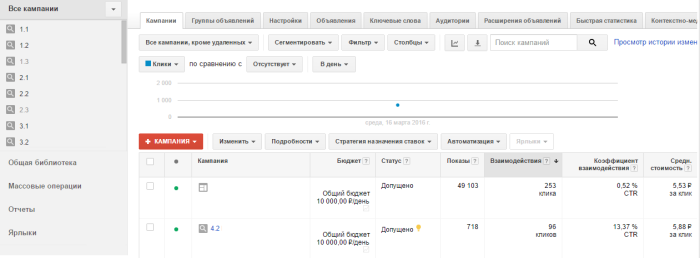

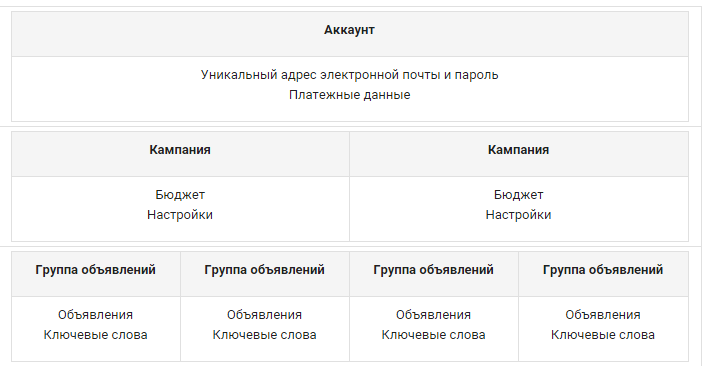

Неопытному пользователю интерфейс может показаться сложным по сравнению с Директом, однако в действительности аккаунт в Adwords более структурирован и выглядит следующим образом:

Ключевые слова

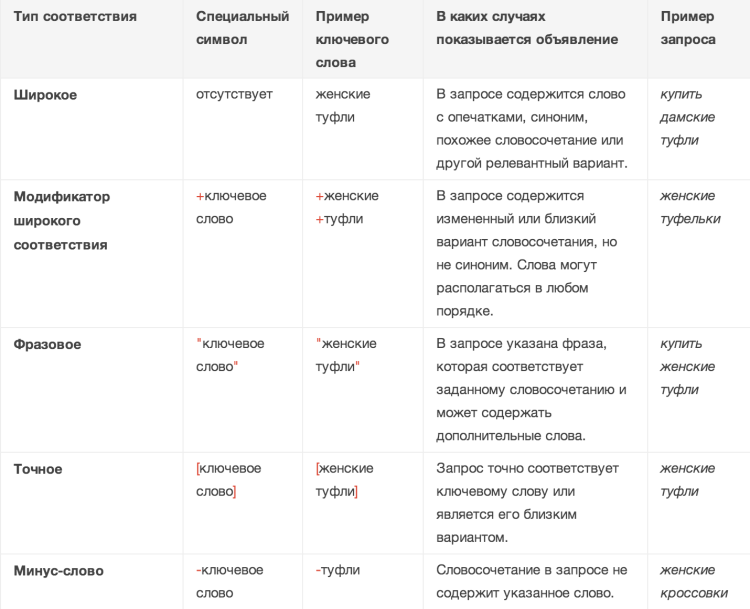

Каждое ключевое слово имеет настройки типа соответствия:

- широкое,

- модификатор широкого соответствия,

- фразовое,

- точное.

По умолчанию все слова используются в широком соответствии (если не использовать операторы).

Минус-слова настраиваются в виде списков как на уровне кампаний, так и на уровне групп объявлений, им также можно задать определенный тип соответствия.

Виды размещения

Контекстная реклама размещается в Google на следующих площадках:

- в контекстно-медийной сети (КМС), т. е. на сайтах партнеров.

- в поисковой выдаче.

Можно использовать как классический текстовый формат объявлений, так и баннеры, и статичные изображения, и видео.

Quality Score

В данном сервисе существует показатель, напрямую влияющий на ставку – Quality Score (показатель качества). QS учитывает релевантность запроса и объявления, качество посадочной страницы, CTR.

При плохом показателе качества существенно повышаются ставки, или объявление может вовсе не показываться. А при наличии оптимизированной посадочной страницы, релевантных объявлениях, проработанном списке ключевых слов и хорошем показателе качества, ставки будут минимальны, а объявления будут показаны на максимально выгодных для рекламодателя позициях.

Автоматизированные правила

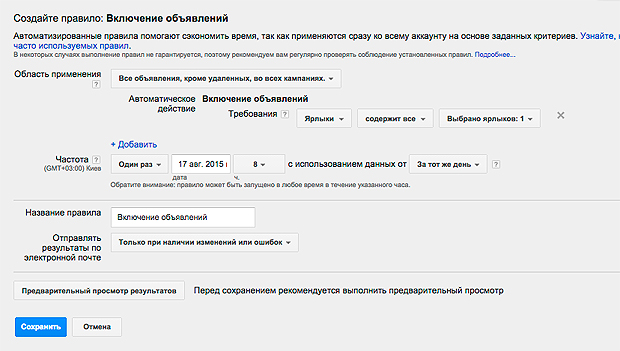

В Google.Adwords можно создавать множество автоматизированных правил для регулярно выполняемых задач:

- автоматическая корректировка ставок;

- включение и отключение объявлений по расписанию;

- планирование показа объявлений, приуроченных к определенному событию или акции;

- приостановка малоэффективных объявлений;

- уведомление по электронной почте о почти исчерпанном бюджете в начале дня.

При правильных настройках это экономит время и рекламный бюджет.

Геотаргетинг

Можно настроить рекламу пользователям с учетом:

- удаленности до 5 км от целевого местоположения;

- языкового таргетинга (показ объявлений пользователям, владеющими определенным языком).

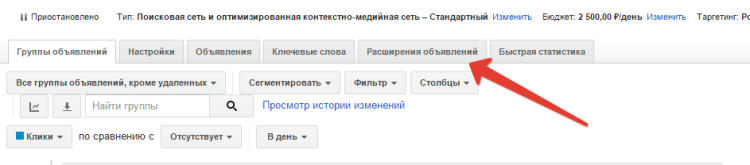

Расширенные объявления

Функционал Adwords позволяет настроить расширенные объявления. Например, адрес и рейтинг магазина, номер телефона или ссылки на различные разделы сайта. Список расширений больше, чем аналогичные настройки в Яндекс.Директе.

Вывод

Adwords позволяет настраивать контекстную рекламу и привлекать целевую аудиторию из поисковой сети Google. Чем лучше вы проработаете ключевые слова, посадочную страницу, тем больше конверсий получите. Но чтобы не не потерять ни одного клиента, настраивайте контекстную рекламу в двух поисковых системах – в Google.Adwords и Яндекс.Директ.

Даже ключевые слова нужно собирать отдельно и это тоже важно!

In a world of of rapidly changing finance and variable costs sometimes situations appear where you need to get financial support until your next salary. In this context, a wages loan becomes one of the famous financial tools. It is necessary to consider is and how it can be can be useful.

1. Definition of Loan up to Wages

A loan up to salary is a short-term type of payday loans provided to the borrower on the terms of repayment on the day of receipt of his next salary. As usual such loans have small amounts, and their purpose is to assist the borrower to cope with temporary financial difficulties until the subsequent payment of wages.

2. Superiorities of a loan up to Wages

Urgency: Pre-salary loans as usual are issued quickly, making them an attractive solution for those faced with unexpected expenses .

Ease of Obtaining: The process of design of such loans is as usual small. The borrower often require provide only basic information and confirmation of stable income.

No Credit History: For many loans up to wages there is no needed verification of the credit history of the borrower, which is a big advantage for those , who do not have fair credit history.

3. Features of Repayment and Interest Rates

Repayment Term: Usually the loan term until salary is several weeks or until subsequent salary of the borrower.

Interest Rates: The rates on such loans may be higher than long-term loans because they are provided on a short-term basis and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Fundamentally choose only reliable financial organizations and legitimate lenders, since regulation here helps prevent dishonest practices.

Protection of consumers: Laws and regulations provide protection of consumers, including transparency of conditions of credit and provision of complete information about interest and fees.

5. Caution and Alternatives

Consideration of Alternatives: Before applying for a loan up to wages, it is worth considering other options, including borrowing from friends or families, appeal to charitable organizations or consider other monetary possibilities.

Wise Use: Important use credit before salary wise and responsibly, avoiding constant application for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that can be useful in situations of short-term financial problems. However, it should be used with caution, observing repayment deadlines and choosing reliable lenders. Remember that financial security is an important nuance of your personal card game, and smart financial planning will help avoid excessive monetary problems.

Across the world of rapidly changing money and variable costs sometimes situations arise where you need to get financial support until your subsequent salary. In this context, a salary loan becomes one of the favorite monetary tools. Let’s look at what kind of lending this is and how it can be useful.

1. Definition of Loan up to Wages

A loan up to salary is a short-term type of loans near me provided to the borrower subject to repayment on the day of receipt of his next salary. As usual such loans have small amounts, and their purpose is to assist the borrower to cope with temporary financial difficulties until the subsequent payment of wages.

2. Advantages of a loan up to Wages

Urgency: Pre-salary loans usually are issued quickly, making them an pretty solution for those faced with unexpected expenses .

Ease of Obtaining: The process of design of such loans is as usual minimal. The borrower often needs provide only basic information and proof of stable income.

No Lending History: For many loans up to wages there is no needed verification of the credit history of the borrower, which is a big advantage for those , who do not have fair lending history.

3. Features of Repayment and Interest Rates

Repayment Term: Usually the loan term until wages is several weeks or until next salary of the borrower.

Refinance Rates: The rates on such loans may be higher than long-term loans since they are provided on a short-term basis and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Important choose only reliable financial organizations and legal lenders, since regulation in this area helps prevent unfair practices.

Protection of consumers: Laws and regulations provide protection of consumers, including transparency of criteria of credit and provision of complete information about interest and fees.

5. Caution and Alternatives

Consideration of Alternatives: Before applying for a loan up to salary, it is worth considering other options, such as borrowing from friends or families, appeal to charitable organizations or consider other monetary possibilities.

Reasonable Implementation: Important use credit before salary appropriate and responsibly, avoiding constant application for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that can be useful in situations of short-term monetary problems. However, it should be used with caution, observing repayment deadlines and electing reliable lenders. Remember that financial security is an important aspect of your personal card game, and smart money planning will help avoid excessive financial problems.

Across the world of rapidly changing finance and variable costs from time to time situations arise where you need to get financial support until your subsequent salary. In this context, a salary loan becomes one of the fashionable financial tools. It is necessary to consider is and how it can be useful.

1. Definition of Loan up to Salary

A loan up to wages is a short-term type of payday loans provided to the borrower subject to repayment per day of receipt of his subsequent wages boards. Usually such loans have small amounts, and their purpose is to help the borrower to cope with temporary financial difficulties until the next payment of salary.

2. Superiorities of a loan up to Salary

Urgency: Pre-payday loans as usual are issued soon, making them an attractive solution for those faced with unexpected expenses .

Ease of Obtaining: The process of design of such loans is as usual minimal. The borrower often needs provide only basic information and proof of measured income.

No Lending History: For most loans up to wages there is no needed verification of the credit history of the borrower, which is a big advantage for those , who do not have fair lending history.

3. Features of Repayment and Refinancing Rates

Repayment Term: As usual the loan term until salary composes several weeks or until next wages of the borrower.

Refinance Rates: The rates on such loans can be higher than long-term loans since they are provided on a short-term basis and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Fundamentally choose only reliable financial organizations and legitimate lenders, since regulation here helps prevent dishonest practices.

Protection of consumers: Laws and regulations ensure protection of consumers, including transparency of conditions of credit and provision of complete information about interest and fees.

5. Prudence and Alternatives

Consideration of Alternatives: Before applying for a loan up to wages, it is worth inspecting alternative options, including borrowing from friends or families, appeal to charitable organizations or consider other financial possibilities.

Reasonable Implementation: Mainly use credit before salary appropriate and responsibly, avoiding constant application for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that can be useful in situations of short-term financial problems. However, it should be used with caution, observing repayment deadlines and choosing reliable lenders. Remember that financial security is an important nuance of your personal cards, and smart money planning will help avoid excessive monetary difficulties.

Across the world of rapidly changing money and variable costs sometimes situations appear where you need to get financial support until your subsequent salary. In this context, a wages loan becomes one of the famous monetary appliances. It is necessary to consider what kind of lending this is and how it can be useful.

1. Definition of Loan up to Wages

A loan up to wages is a short-term type of loans provided to the borrower on the terms of repayment per day of receipt of his next salary. As usual such loans have small amounts, and their purpose is to assist the borrower to cope with temporary financial difficulties until the next payment of wages.

2. Advantages of a loan up to Wages

Urgency: Pre-salary loans as usual are issued soon, making them an pretty solution for those faced with sudden expenses .

Ease of Obtaining: The process of design of such loans is usually small. The borrower often require provide only basic information and proof of stable income.

No Lending History: For many loans up to wages there is no needed verification of the credit history of the borrower, which is a big advantage for those , who do not have excellent credit history.

3. Features of Repayment and Interest Rates

Repayment Term: Usually the loan term until wages is several weeks or until subsequent wages of the borrower.

Refinance Rates: The rates on such loans can be higher than long-term loans since they are provided on a short-term base and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Important choose only reliable monetary organizations and legal lenders, since regulation in this area helps prevent dishonest practices.

Safety of consumers: Laws and regulations ensure protection of consumers, including transparency of conditions of credit and provision of complete information about interest and fees.

5. Prudence and Candidates

Consideration of Alternatives: Before applying for a loan up to salary, it is worth considering other options, including borrowing from friends or families, appeal to charitable organizations or consider other monetary possibilities.

Wise Use: Fundamentally use credit before salary wise and responsibly, avoiding constant application for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that possibly useful in situations of short-term financial problems. However, it should be used with caution, observing repayment deadlines and electing reliable lenders. Remember that financial security is an important aspect of your personal cards, and smart financial planning will help avoid excessive monetary difficulties.

In a world of of rapidly changing money and variable costs sometimes situations appear where you need to get financial support until your subsequent salary. In this context, a salary loan becomes one of the popular financial appliances. Let’s look at is and how it can be useful.

1. Definition of Loan up to Salary

A loan up to wages is a short-term type of loans provided to the borrower subject to repayment per day of receipt of his next wages boards. Usually such loans have small amounts, and their purpose is to assist the borrower to cope with temporary financial difficulties until the next payment of salary.

2. Superiorities of a loan up to Wages

Urgency: Pre-payday loans usually are issued quickly, making them an attractive solution for those faced with sudden expenses .

Ease of Obtaining: The process of design of such loans is usually minimal. The borrower quite often needs provide only basic information and confirmation of stable income.

No Credit History: For most loans up to salary there is no required verification of the credit history of the borrower, which is a big advantage those , who do not have fair lending history.

3. Features of Repayment and Interest Rates

Repayment Term: Usually the loan term until wages composes several weeks or until subsequent wages of the borrower.

Refinance Rates: The rates on such loans may be higher than long-term loans because they are provided on a short-term base and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Fundamentally choose only reliable financial organizations and legal lenders, since regulation in this area helps prevent negligent practices.

Protection of consumers: Laws and regulations ensure protection of consumers, including transparency of conditions of credit and provision of complete information about interest and fees.

5. Prudence and Candidates

Consideration of Alternatives: Before applying for a loan up to salary, it is worth considering other options, such as borrowing from buddies or families, appeal to charitable organizations or consider other financial possibilities.

Reasonable Implementation: Important use credit before salary wise and responsibly, avoiding constant appeal for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that possibly useful in situations of short-term financial difficulties. However, it should be used with caution, observing repayment deadlines and choosing reliable lenders. Remember that financial security is an important aspect of your personal card game, and smart money planning will help avoid excessive monetary problems.